Know why Crane Bank’s MD A.R Kalan fled

SUDHIR REPORTEDLY TOOK 300 BILLION ILLEGALLY FROM CRANE BANK AND IS IN COURT ON 90 MILLION DOLLARS FRAUD. HE THEN HELPED WOULD-BE WITNESS TO FLEE THE COUNTRY

The former Crane Bank Managing Director, A. R. Kalan fled Uganda in 2014 after coming under pressure from his boss, Sudhir Ruparelia.

In 2014, leaks from Crane Bank to authorities pointed to massive fraud, money laundering, falsification of information to mislead the regulator (BoU), embezzlement of funds from the bank’s internal accounts and bribery of auditors.

Fearing that Kalan would act as a witness in a possible trial of Crane Bank management, Sudhir forced his right hand man to flee the country.

Kalan first travelled to Lebanon from where he relocated to United States.

In America, Kalan chose to take a low profile fearing for his life if he returned to Uganda. Kalan has two kids and a wife whom he jealously protects.

But authorities are now promising Kalan pardon from prosecution if he helps pin Sudhir in the upcoming trial and recovery of $90m which the tycoon irregularly took from the bank to shore up his real estate business in Uganda and Jumeirah, Dubai.

If Kalan refuses to cooperate, the Interpol facilities will be activated to repatriate him to Uganda to face the full wrath of the law.

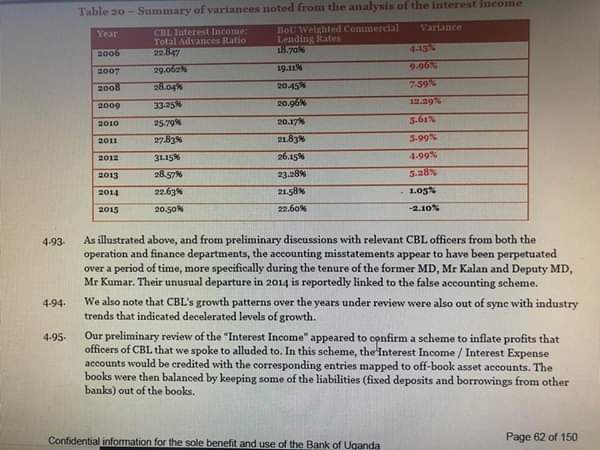

An investigation by auditors confirmed (as shown below) that Kalan’s “unusual departure in 2014 is reportedly linked to the false accounting scheme.”

This revelation and confidential document in our possession disprove earlier claims that Kalan stole money from Crane Bank and ran away.

The truth is Sudhir facilitated Kalan’s escape and protection to save the Ruparelia business empire as authorities moved in.

In Uganda, Kalan will pin Sudhir Ruparelia on the following:

That as a Director, major shareholder and person who exerted the greatest control over the Bank, Dr Ruparelia:

(a). Concealed the true extent of his shareholding in the Bank.

(b). Conspired with other CBL directors, and officers to effect the irregular transfer of the Crane Bank’s branch ownership to Meera Investments, a company fully owned by the Ruparelia family.

(c). Benefitted/received dividends payable to Mr Kantaria/White Sapphire

(d). Conspired with others to embezzle Crane Bank through cash extractions such as those involving Interdico, and Technology Associates, bearing in mind the 32 false invoices and the draft special resolution for the opening of an Interdico bank account, created on the computers of CBL staff, together with the admission by Technology Associates that no software licences were ever provided.

(.e). He was instrumental in the approval of credit facilities related companies and associates in more favourable circumstances than those of other CBL customers.

(f). Failed to declare his interests when carrying out his role as a Director, which resulted in unlawful gain for companies associated with him.

If prosecutors secure conviction on these charges, Sudhir will spend his entire life in jail.

In case Kalan does not help, authorities will pin them on the following:

In addition to being a director, as the Managing Director of the Bank from 2006 to 2014, Mr Kalan played a key role in the mismanagement of the Bank and in false accounting. In particular, he:

(a). Was involved in concealing the true ownership of the Bank as evidenced by his settling White Sapphire’s expenses and directing the transfer of funds from Mr Kantaria’s account;

b. Moved the motion to transfer the ownership of the Bank’s land to MIL in 2012.

c. Authorised the fraudulent payments to Interdico, and Technology Associates.

d. Oversaw the procurement of T24, CBS and Misys international banking systems without reference to any procurement policy or evidence of Board approval, thereby causing financial loss to CBL In respect of the award of contracts to Technology Associates, (A company related to Ruparelia), and Temenos without apparent approval from the Board, at a price that was out of all proportion with the market value of the equipment obtained, for products that were in some cases not provided, e.g. licences from Technology Associates.

e. Oversaw the irregularities in loan approvals and loan impairments, where related companies, associates of Dr Ruparelia, (who were often bad debtors), were given loans against inadequate securities, resulting in default, whereupon further credit was given, or loans were written off without being pursued in court.

In addition to the charges against the Board of Directors, there is sufficient evidence for charges to be pursued against Mr. Kalan in respect of the irregular shareholding of Mr. Kantaria, the transfer of CBL branch properties to MIL, and the fraudulent payments to Interdico and Technology Associates, in a manner similar to that of Dr Ruparelia.

The law is very clear: “Any person employed by the Government, a bank, a credit institution, an insurance company or a public body, who in the performance of his or her duties, does any act knowing or having reason to believe that the act or omission will cause financial loss to the Government, bank, credit institution commits an offence and is liable on conviction to a term of imprisonment not exceeding fourteen years or a fine not exceeding three hundred and thirty six currency points or both.”

Authorities want Sudhir to pay back $90m and also serve a jail sentence to send a signal to bankers that fraud has not place in Uganda.