IS CUSTOMER’S MONEY IN POSTA BANK SAFE?

The sate House Anti-Corruption Unit on Friday 5th April 2019 opened up investigations on some top individual officials in Post Bank over fraud and abuse of office.

This came after the unit led by Lt. Col Edith Nakalema was tipped with credible information by the Internal Security Organization (ISO) about the fraudulent Post Bank top officials.

Acting inline with Article 99 (4) of the Constitution of Uganda, in connection with the Criminal Investigation Directorate acting under Article 120 (3) (a) and the Office of the Auditor General acting under Article 163 (3), Nakalema’s teams’ investigation on Post Bank officials are normal and will not interfere with bank’s operations, The Drone Media has been informed.

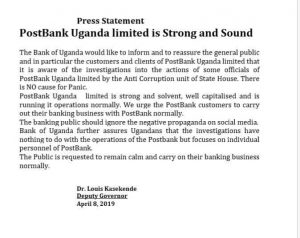

It should be noted that the matter under investigation is abuse of office and bank operations remain uninterrupted, the anti-corruption unit confirmed in a statement.

It adds: “This investigation is being carried out in consultation with Bank of Uganda and Ministry of Finance, Planning and Economic Development.

On this note all Post Bank Customers have been assured that the liquidity of the bank is stable. They are argued to remain calm and should not be worried with the investigations as they will not be affected at all.

Post Bank Uganda is a non-bank credit institution in Uganda. Its activities are supervised by the Bank of Uganda, the country’s Central Bank and national banking regulator.

The bank has been in existence since 1926. It started out as a department in the Post Office. In February 1998 Post Bank Uganda Limited was incorporated in accordance with the Communications Act of 1997 to take over the operations of the former Post Office Savings department.

Post Bank Uganda was incorporated under the Companies Act in February 1998 as a limited liability company. The bank’s operations are supervised by the Bank of Uganda under the Financial Institutions Act. It is classified as a Tier II Institution (Non-Bank Credit Institution), by the Bank of Uganda.

Post Bank Uganda subscribes to the Depositors Insurance Scheme at Bank of Uganda. If Post Bank Uganda fails, the bank’s depositors are insured up to Sh 3 million (approximately US$1,600.00) in 2009, per eligible account. In 2009, Post Bank Uganda applied to the Bank of Uganda to become a fully licensed commercial bank.

In February 2016, Ugandan media sources reported that the government was planning to merge Posta Bank Uganda with Pride Microfinance, to form an agricultural bank. However, the allegation disappeared as it came about.